japan corporate tax rate kpmg

National Tax Agency 10Y 25Y 50Y MAX Chart Compare Export API Embed Japan Corporate Tax Rate In Japan the Corporate Income tax rate refers to the highest corporate tax rate for companies with taxable income above 8 million JPY a year based in Tokyo. KPMG Japan tax newsletterJuly 2017 5.

The Tap Runs Dry The Economist

The regular business tax rates vary between 03 and 14 depending on the tax base taxable income and the location of the taxpayer.

. National local corporate tax Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their. The special local corporate tax rate is 4142 and is. KPMG in Japan was established when KPMG opened a network office in 1954.

Japan 4069 4069 40. Using international and Japan-specific empirical estimates of. Real estate acquisition tax is levied at 4 percent of the appraised value of the property.

The other countries at the top of the list are Brazil. This booklet is intended to provide a general overview of the taxation system in Japan. Japan corporate tax rate kpmg.

Country Tax Profile - assetskpmg. This paper explores how corporate income tax reform can help Japan increase investment and boost potential growth. While the information contained in this booklet may assist in.

Insights Industries Services Careers Events About. Regular business tax rates currently apply and vary between 22. The average value for Japan during that period was 36 percent with a minimum of 3062 percent in 2019.

However an SME defined as a company with paid-in capital of JPY 100 million or less except for a company wholly owned by a company that has paid-in capital of JPY 500 million or more after the group taxation regime is effective may take a tax deduction up to the smaller of the actual disbursement for the entertainment expense or JPY 8 million. Although the effective tax rate ETR for a CFC was used as a starting point. KPMGs corporate tax table provides a view of corporate tax rates around the world.

The amount of taxes a person in Belgium has to pay. Share with your friends. Since then the tax practice has strived to continually provide our clients with consistent high quality service that.

For land the tax rate is reduced to 15 percent until 31 March 2023. The Corporate Tax Rate in Japan stands at 3062 percent. Japan corporate tax rate kpmg Monday February 21 2022 Edit.

A Specified CFC is a concept. Tax rates tool test page. Business tax comprises of three variables regular business tax special local corporate tax and size-based business tax.

Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer. This rate is reduced. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is.

For land the tax rate is reduced to 15 percent until 31 March 2023. All information contained in this publication is. Taxation in Japan 2020.

Taxation in Japan 2021. For that indicator we provide data for Japan from to.

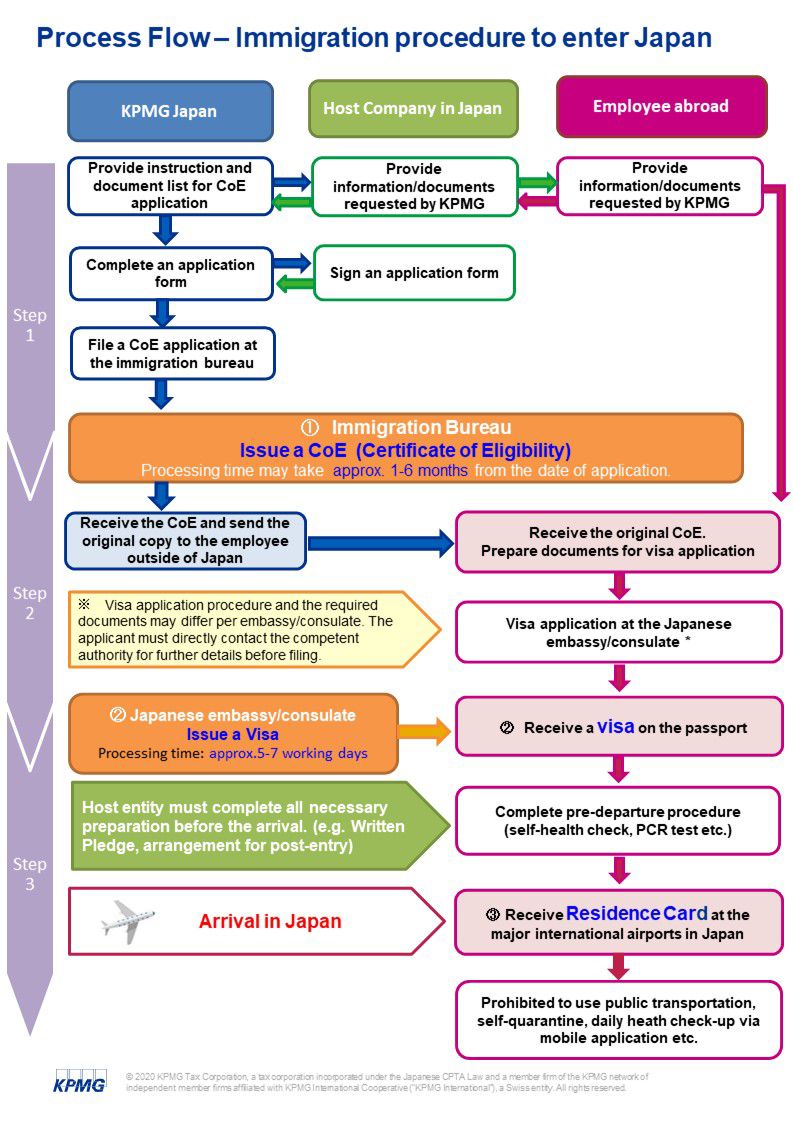

Japan Taxation Of International Executives Kpmg Global

Taxnewsflash Europe Kpmg United States

Vernimmen Corporate Finance The Vernimmen Com Letter

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

What The Coming Tax Cuts Mean For The Stock Market

2022 Tax Reform Passage Of The Bills Kpmg Japan

House Of Commons Treasury Written Evidence

Cutting Us Corporate Taxes The Biggest Winners Are Likely To Be Sha

Japan Corporate Tax Rate 2022 Take Profit Org

Korea Taxation Of Cross Border M A Kpmg Global

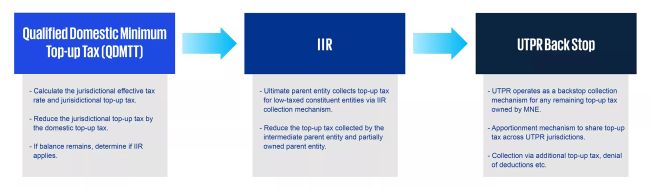

The Brave New World Of Global Minimum Taxation Corporate Tax Malta

Kpmg Tax Corporation Kpmg Japan

United States Taxation Of Cross Border M A Kpmg Global

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

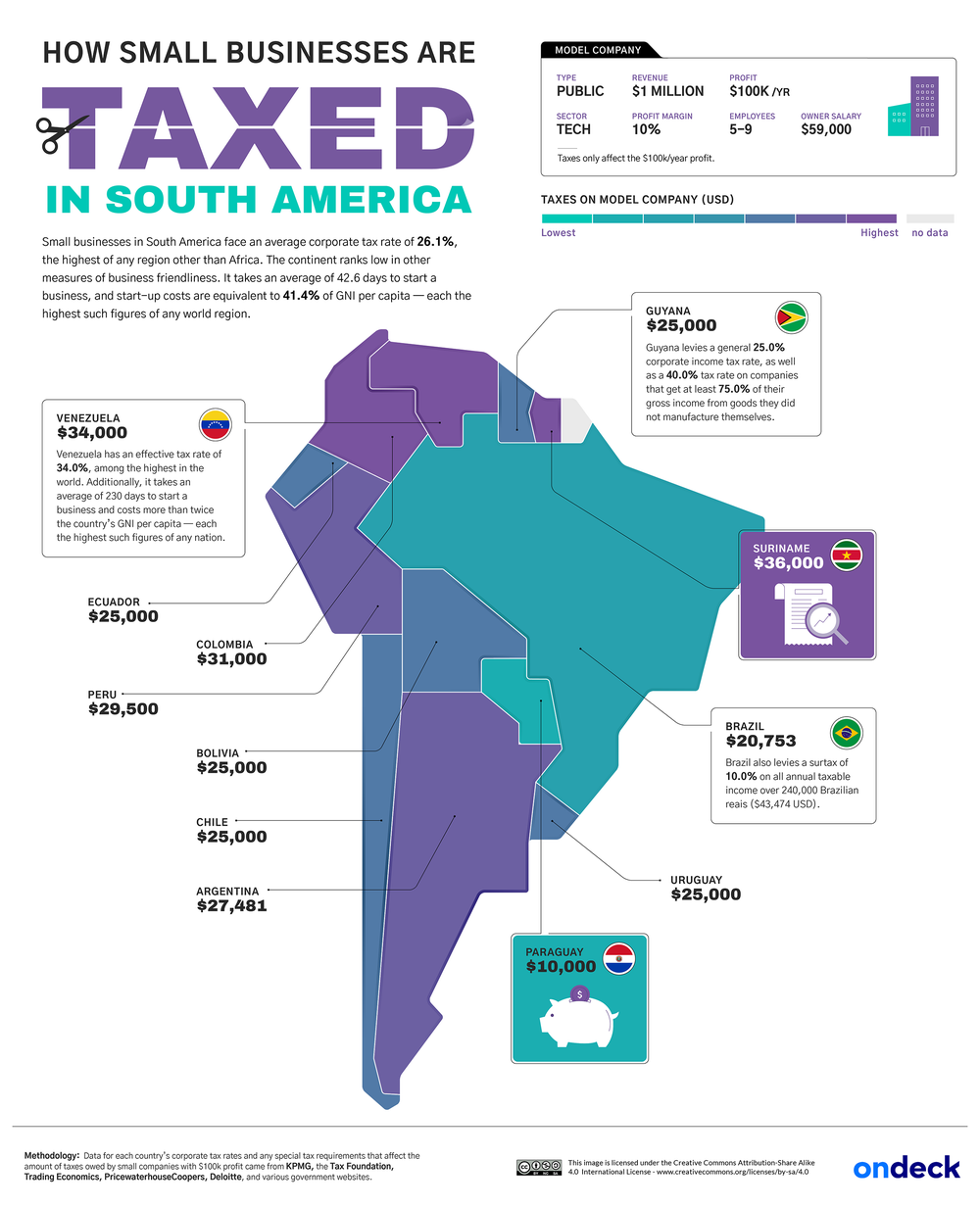

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

Jp Extended Tax Filing And Payment Deadlines Kpmg Global